Business Resources for COVID-19 Relief

State Level

Hospitality Emergency Grant Program

The grant is administered by Department of Commerce and Economic Opportunity (DCEO) to provide relief for bars, restaurants, and lodging establishments like hotels and motels.

Funds Available: $14 million to provide grants to eligible bars and restaurants for rent, payroll, job training, and technology enabling new operation and eligible lodging establishments for the retention of employees.

Eligibility and grant limits:

- Bars and restaurants that generated between $500,000 and $1 million in revenue in 2019 are eligible for up to $25,000

- Bars and restaurants that generated less than $500,000 in revenue in 2019 are eligible for up to $10,000

- Lodging establishments that generated less than $8 million in revenue in 2019 are eligible for up to $50,000

Applications for the Grant Program will be accepted on dceocovid19resources.com until April 1, 2020 at 5:00pm. Qualifying businesses will be notified by April 4, 2020 and funds will be made available within two days of receiving the necessary bank information.

Illinois Small Business Emergency Loan Fund

The loan program is administered by DCEO and IDFPR to offer small business loans of up to $50,000 at 3% interest (current prime rate is 4.25% based on SBA projections) with a five-year repayment period and no payments due for the first six months. Loan funds must be used for working capital (rent, payroll, job training, etc) with at least 50% of the loan applied to payroll or other compensation.

Eligibility and loan limits:

- Business located outside of the City of Chicago with fewer than 50 workers and less than $3 million in revenue in 2019 and that have experienced at least a 25% decrease in revenue as a result of COVID-19 may receive up to $50,000

Businesses should complete and submit an expression of interest on

https://www2.illinois.gov/dceo/SmallBizAssistance/Pages/IllinoisSmallBusinessEmergencyLoanFund.aspx. Lending partners will begin accepting official applications and will contact eligible business that have expressed interest on April 1, 2020.

Chicago Small Business Resiliency Fund

The low interest loan program is for businesses located within the City of Chicago and provides loans of up to $50,000.

Eligibility: The business must have fewer than 50 employees and less than $3 million in revenue in 2019 and experienced more than a 25% revenue decrease as a result of COVID-19. At least 50% of the loan must be used for working capital and the business has committed to retaining at least 50% of its pre-COVID-19 workforce.

Applications will begin being accepted on March 31, 2020 and business can apply online at https://www.surveymonkey.com/r/COVID19Chicago

Downstate Small Business Stabilization Program

The program is administered by DCEO to offer small businesses of up to 50 employees the opportunity to partner with their local governments to obtain grants of up to $25,000 in working capital.

Funding: $20 million

Eligibility: Local governments can apply on behalf of businesses. Only cities, villages, and counties that are not a HUD direct entitlement community or located in an urban county that receives “entitlement” funds are eligible to apply (see below for ineligible counties and cities.)

Businesses are encouraged to contact their local governments to submit applications and to view eligibility online at

DCEO’s SBA website and resources can be found here:

https://www2.illinois.gov/dceo/SmallBizAssistance/Pages/EmergencySBAIntiatives.aspx

Illinois State Treasurer – Bridge Loan Program

The State Treasurer’s Office has launched a bridge loan program to help during the COVID-19 outbreak. This program makes $250 million in state assets available to banks and credit unions across the state at historically low interest rates of almost zero.

The Treasurer will deposit a quarter of a billion dollars from the state’s portfolio in increments of $1 million or $5 million to financial institutions across the state. In turn, the institutions have agreed to turn around and use the money to help small businesses and nonprofits, pay rent, purchase supplies, and make payroll.

Information about this program can be found here: https://www.illinoistreasurer.gov/Invest_in_Illinois/Small_Business_COVID-19_Relief_Program

Federal Level

The U.S. Small Business Administration (SBA) offers a number of loan programs designed to help assist small businesses succeed pre and post COVID-19 pandemic.

Economic Injury Disaster Loan Program

The loan program provides small businesses (typically businesses with fewer than 500 employees) with working capital loans of up to $2 million with a loan advance of up to $10,000.

Express Bridge Loan Pilot Program

The loan program allows small businesses that currently have a relationship with a SBA Express Lender to access up to $25,000 in loans to bridge the gap while waiting for Economic Injury Disaster Loan dollars.

Paycheck Protection Program Loans

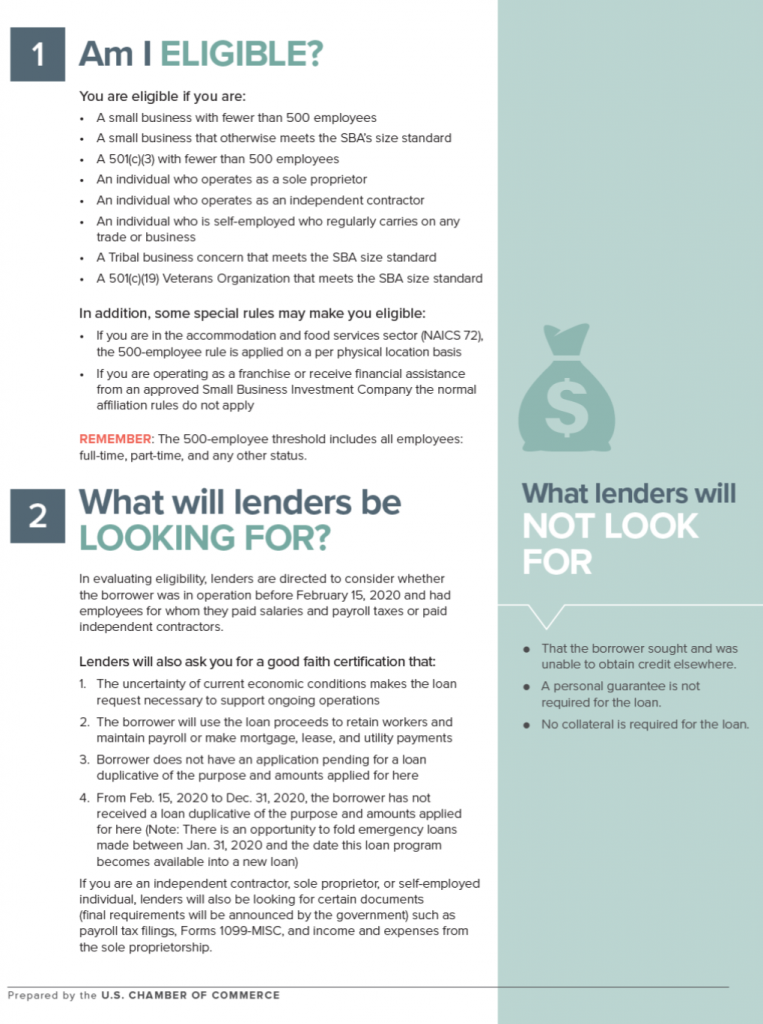

This program prioritizes millions of Americans employed by small businesses by authorizing up to $349 billion toward job retention and certain other expenses. Small businesses and eligible nonprofit organizations, Veterans organizations, and Tribal businesses described in the Small Business Act, as well as individuals who are self-employed or are independent contractors, are eligible if they also meet program size standards. Under this program:

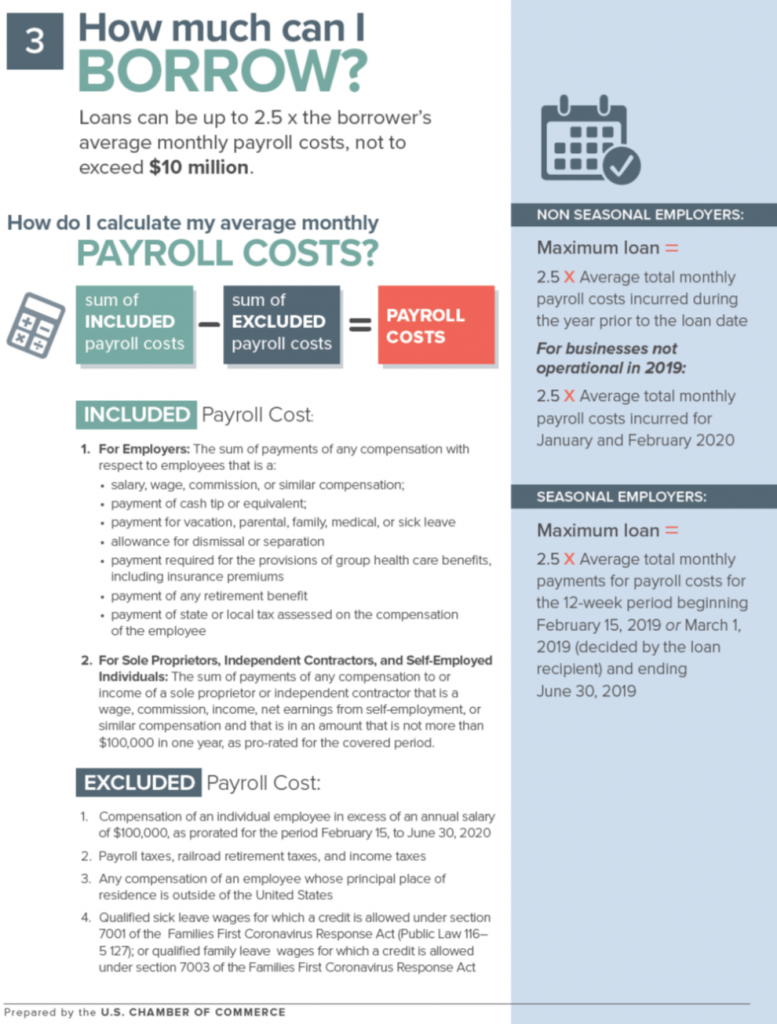

- Eligible recipients may qualify for a loan up to $10 million determined by 8 weeks of prior average payroll plus an additional 25% of that amount.

- Loan payments will be deferred for six months.

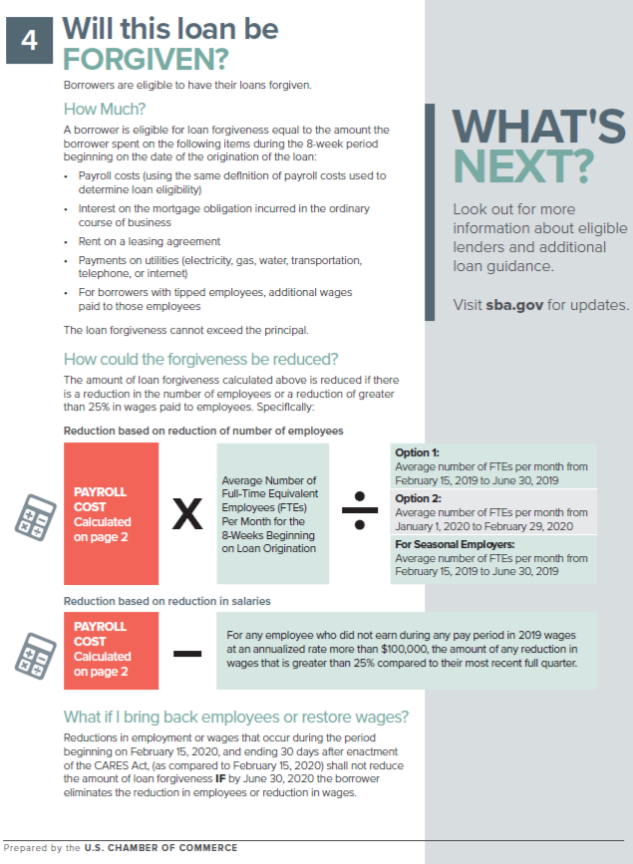

- If you maintain your workforce, SBA will forgive the portion of the loan proceeds that are used to cover the first 8 weeks of payroll and certain other expenses following loan origination

Applications for these loans and other SBA loans are available on their website: https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources

Nonprofit Grants

The United Way of Illinois and the Alliance of Illinois Community Foundations announced the launch of the Illinois COVID-19 Response Fund (ICRF), a new statewide fundraising effort to support nonprofit organizations serving those whose lives have been upended by this pandemic.

The ICRF is launching with nearly $23 million in initial donations. In the upcoming weeks, the steering committee will evaluate and disburse funds to the initial wave of charitable organizations serving at-need communities across the entire state. All donations and distributions will be available to the public. Donations and applications for assistance can be made here.